We have collectively mismanaged our global portfolio of assets, meaning the demands on nature far exceed its capacity to supply the goods and services we all rely on. Estimates show that between 1992 and 2014, produced capital per person doubled, and human capital per person increased by about 13% globally; but the stock of natural capital per person declined by nearly 40%. Estimates of our total impact on nature suggest that we would require 1.7 earths to maintain the world’s current living standards. If we don’t nurture nature now, we will see irreversible losses in ecosystem services.

The Landbanking Group has set out to offer a natural capital account to everybody with the ambition to prioritize ecological vitality as the primary wealth indicator. Their platform will reward the conservation and regeneration of the natural resources human life is reliant on.

To do that Landbanking allows both sellers and buyers of nature services such as carbon removal, water storage, soil regeneration, or biodiversity protection to open natural capital accounts. Polygons of land are assessed based on novel technologies and verifiable claims are turned into tradeable assets. This allows land stewards to drive land restoration and protection with the necessary, substantial financial backing and a long-term outlook.

Nature as part of the solution

Nature and nature tech will be key to mitigating climate change and achieving an economy that thrives within our planetary boundaries. Its unique offering allows The Landbanking Group to turn investment portfolios and companies nature-positive. The platform will link land stewards with the nature data, incentives, and tools they need to make the most of their land, here, now, and far into the future.

A compelling team

Sonja Stuchtey, Ph.D. (founder of ScienceLab e.V. and Alliance4Europe) and Prof. Dr. Martin R. Stuchtey (former senior partner McKinsey & Company and founder of Systemiq Ltd.) have assembled a team of leading scientists, company builders, technology experts, financial industry professionals, and land specialists. We believe this team will create a ground-breaking market for ecosystem services and products, to mitigate the ongoing loss of biodiversity and ecosystem services.

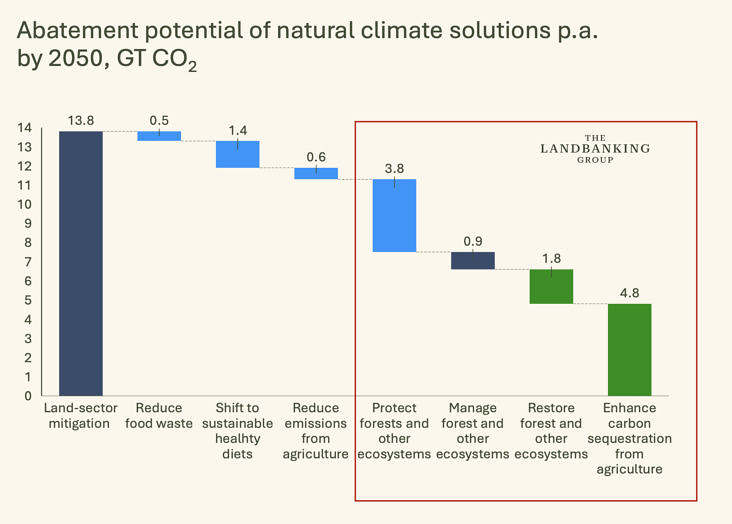

The Landbanking Group is a systems innovation to transform the global land use system. They offer an answer to the 1-million-dollar question “How do we protect and restore nature by making it investable?“. As custodian The Landbanking Group caters to the technical, legal and operational frame, i.e. provides the infrastructure for the nature market. With The Landbanking Group the natural capital that sustains all life is set to become an asset: the cooling effect of forests, the flood prevention characteristics of wetlands and the carbon sequestration abilities of soil will be understood and treated as services with a defined economic value. And the abatement potential of natural climate solutions is about 11.3 GT CO2/a at scale (Griscom et al. 2017), not to speak of the uplift in biodiversity, and the savings in water and other resources.